XRP Price Movements: Analysts Anticipate Mixed Signals

By: Eliza Bennet

XRP, the digital token associated with Ripple Labs, is a subject of intense scrutiny and debate among crypto analysts as the year approaches its close. The market sentiment for XRP appears divided, with predictions varying greatly for its future trajectory. Currently, XRP is witnessing sideways trading, with market indicators pointing to a lack of significant momentum in either direction.

The cryptocurrency had demonstrated resilience and potential for growth in the past, but recent surveys, such as the one conducted by Gemini, reveal a rather bearish outlook among investors. A significant 73% of participants expect XRP to remain below the $2 mark at year's end, a marked drop from earlier expectations where many foresaw a climb to between $2 and $2.50. This shift in sentiment suggests that market participants have grown cautious, reflecting broader uncertainty in the crypto space. Even as early adopters of XRP move to realize gains, selling large volumes at higher prices, the lack of new investor demand has contributed to keeping XRP within restrained trading ranges.

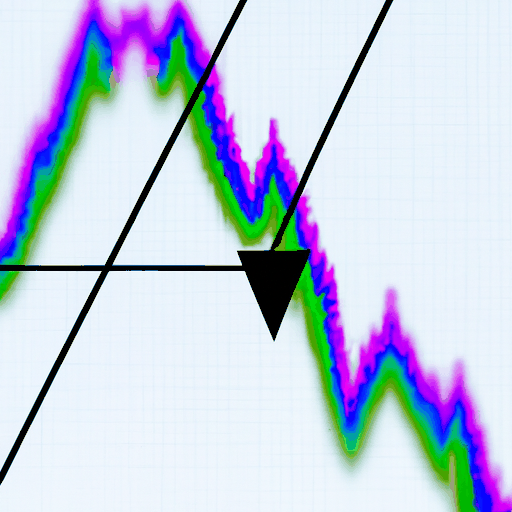

Analysts like Ali Martinez have highlighted the presence of a Symmetrical Triangle pattern in XRP’s recent trading behavior, which often symbolizes a potential breakout. With XRP’s price compressed within this triangle, a breakout could lead to a notable price swing estimated at around 10%. However, symmetrical formations do not inherently suggest a directional bias; hence, the outcome could be either bullish or bearish.

The scenario for XRP remains nuanced, with influential factors such as potential regulatory shifts, increased utility through enhanced integration in payment systems, and shifts in macroeconomic conditions. For now, the coin trades approximately at $1.84, facing resistance from reduced demand and profit-taking actions. As the market waits for definitive signals, XRP's trajectory will likely depend on broader market trends, regulatory developments, and technological advancements within the Ripple ecosystem.