XRP Surges Beyond $1 Mark Amid Record Open Interest Levels

By: Eva Baxter

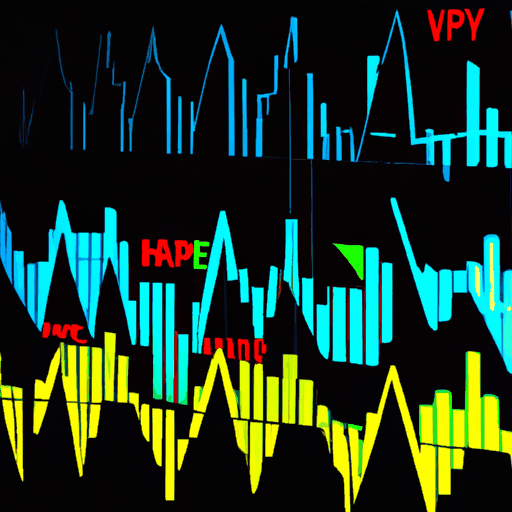

In a significant development for the cryptocurrency market, XRP, the digital asset associated with Ripple, has climbed to a three-year peak, surpassing the $1 threshold. Simultaneously, open interest for XRP futures has reached an unprecedented high of over $2 billion, indicating growing trader interest and market enthusiasm. Over the weekend, XRP momentarily touched $1.19, marking its highest level since 2021, before stabilizing around $1.10. These movements reflect a near 100% appreciation in the token's value over the past week, spurred by a renewed interest linked to the recent U.S. presidential election results.

The current optimism surrounding XRP can be attributed to a number of factors. Market watchers anticipate that Donald Trump's presidency could provide a more favorable regulatory environment for cryptocurrencies like XRP. The ongoing legal tussle between Ripple and the U.S. Securities and Exchange Commission (SEC), a longstanding hurdle, might see steps towards resolution under the new administration, potentially encouraging both retail and institutional investments. Ripple's CEO, Brad Garlinghouse, expressed confidence that the new Congress will prioritize driving innovation by offering regulatory clarity to the crypto sector. This enthusiasm is shared by significant market entities known as whales and sharks—investors holding between 1 million and 100 million XRP—who have reportedly amassed 453.3 million XRP, worth approximately $526.3 million, over the past week.

This strategic accumulation by large stakeholders has prompted some retail investors to offload their XRP holdings, with reports indicating that 75.7 million XRP, valued at around $87.9 million, were sold off by these smaller investors. Such behavior underpins the narrative that significant stakeholder confidence leads to positive growth for a digital asset, as per observations by market intelligence platform, Santiment. The current rally underscores a shift towards greater institutional involvement in XRP, underscored by rising futures open interest levels. The volume of active, yet to be settled futures contracts has soared, paralleling a surge in speculative activity and market volatility.

The phenomenon of rising open interest typically points to increased speculation, often resulting in sharper market reactions due to leveraged trading positions. Analysts suggest that the increased open interest, coupled with intensified buying by influential stakeholders, could fuel further price volatility in the near term. Overall, XRP's robust performance and the corresponding open interest levels highlight a significant shift in market dynamics, as investor sentiment leans toward optimism amidst evolving regulatory discussions and the broader crypto market's resurgence.