ZKasino Scammer's Ethereum Gamble Results in $27M Loss

By: Eva Baxter

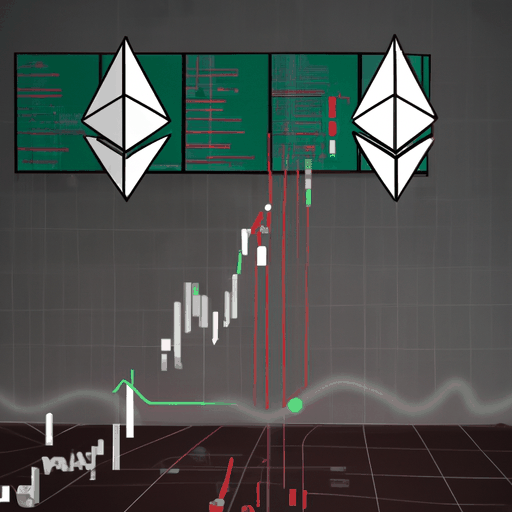

The notorious scammer associated with the ZKasino rug pull has encountered a significant financial setback, losing over $27 million in a high-stakes Ethereum trade amidst ongoing market fluctuations. ZKasino, a platform that attracted attention for executing a massive rug pull, has been the subject of numerous discussions within the crypto community. Reports indicate that the scammer executed a 20x leveraged long position on Ethereum using the Hyperliquid trading platform, which backfired due to a sudden market downturn.

This market turmoil has been partly attributed to the broader economic impacts caused by the US decision to implement reciprocal tariffs affecting 180 countries. Over the course of 24 hours, Ethereum's value saw a precipitous decline, plummeting nearly 20% before staging a modest recovery. As a result, the scammer had to exit the leveraged position, amplifying the financial loss, which many in the crypto space consider a form of poetic justice. Previously, the ZKasino scammer had deceived investors out of approximately $33 million worth of Ethereum.

The scam traces back to April 2024 when ZKasino was launched, luring investors with the promise of a native token airdrop for users bridging Ether to the platform. However, instead of delivering on these promises, ZKasino managed to divert the funds to Lido Finance, leaving investors empty-handed. The actions of the platform drew intense criticism, including from Ethereum co-founder Vitalik Buterin, who condemned the misuse of the 'ZK' branding to deceive users.

The consequences of the ZKasino scam have extended beyond financial losses. Legal actions have been initiated with the Netherlands' Fiscal Information and Investigation Service arresting a suspect connected to the scheme. The authorities have also seized substantial assets, including digital currency holdings and luxury properties valued at over $12 million. Despite legal proceedings, there remains skepticism regarding the promised return of investor funds. As the crypto community grapples with these developments, the ZKasino saga serves as a cautionary tale about the risks inherent in overleveraging and the importance of regulatory oversight.