Learn Concept: The Legal Side of Crypto Exchanges and their Founders

By: Isha Das

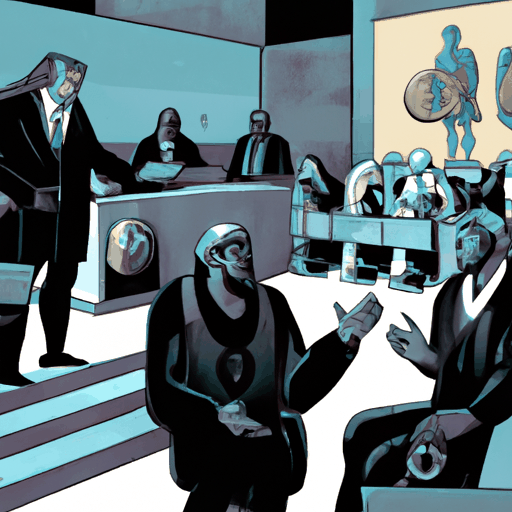

In the advanced realm of cryptocurrency, legal troubles for exchanges and their founders have become increasingly conspicuous. Crypto moguls globally have faced serious allegations and potential legal consequences. This includes charges of unregistered trading operations, mishandled customer assets, or undefined legal frameworks within their exchanges. Battles in courts often shed light on the internal affairs of these crypto giants, revealing surprising information about the founders' interaction with legal procedures, decision-making processes, and their understanding of legal regulations in the crypto space.

The crypto world is continuously evolving with new technologies, products, and services. At the same time, the legal and regulatory landscape also continues to develop, with various countries scrutinizing crypto trading platforms operating within their jurisdictions. Despite the common belief that cryptocurrency operates in a 'wild west' regulatory environment, the reality is that these businesses have to navigate a complex matrix of national and international laws.

The stakes are considerably high for both the crypto exchanges and their founders and regulators alike. For founders, disputes with regulators can lead to significant financial loss, potential jail time, and reputational damage. On the other hand, regulators have to balance the enforcement of laws while also facilitating innovation in the growing and increasingly important field of cryptocurrency.